Introducing The First Interactive Polkadot & Kusama Ecosystem Map

What is Polkadot? In Q3 2022, major media outlets, podcasts, and financial advice platforms were asking this same question. A layer-0 sharded protocol design with Nominated Proof-of-Stake consensus means that Polkadot and Kusama are able to solve the blockchain trilemma: the system is secure, scalable and highly decentralized, allowing a plethora of parachains (layer-1 blockchains) and decentralized apps (DApps) to run without a glitch.

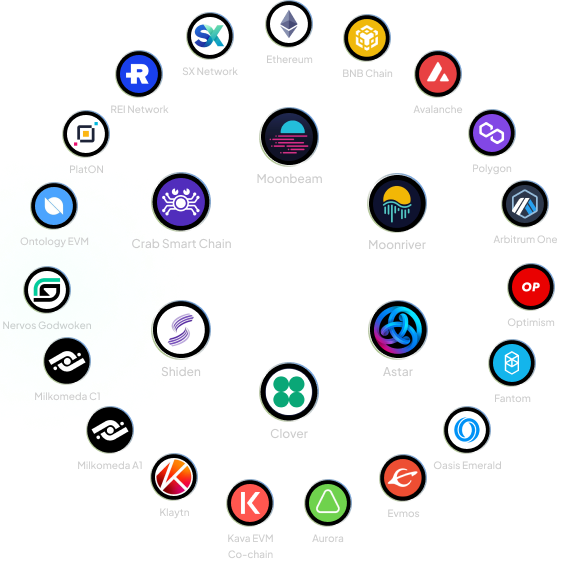

With a view to providing a panoramic picture of the ever-expanding Polkadot and Kusama ecosystem, SubWallet has built the first interactive Polkadot & Kusama Ecosystem Map that covers 500+ projects spanning 25 categories with the support of Parity Technologies. From DeFi, SocialFi, Identity, NFT Marketplaces, Metaverse, Gaming to Bridge, Infrastructure, Smart Contract, Tooling, Data and Privacy solutions, in Q3 2022, the Polkadot and Kusama ecosystem was bustling with activities and brimming with promise.

Ecosystem Overview

Financial Status & Development Activity

The crypto winter continued well into Q3 2022, but DOT got off on the right foot. With an open price of $7.05 on July 1, DOT continued its majorly upward trend and peaked at $9.66 on August 13 with a market cap of $10.28B. However, a zoomed out year-to-date picture would show Q3’s weaker performance compared to the previous two quarters. On September 21, DOT took a dip to $6.00 at $6.89B market cap, a 75.60% loss compared to the beginning of the year.

Token Price vs. Development Activity

The surge to $10.51B market cap on August 10 pushed Polkadot above Dogecoin in the market cap ranking, but with this dive in the second half of Q3, Polkadot again lost its position to Dogecoin and now ranked 11th in terms of market cap.

KSM price reached its peak sooner than DOT’s on July 22 at $69.60, but took a steep slide and went as low as $37.77 on September 19 with a market cap of $339.65M. Again, KSM price and market cap’s pattern were relatively similar to DOT’s.

Development Activity Comparison

Top 10 Networks By 30-Day Development Activity

| # | Project | Dev activity |

|---|---|---|

| 1 |

|

494.93 |

| 2 |

|

494.93 |

| 3 |

|

429.23 |

| 4 |

|

386.47 |

| 5 |

|

347.87 |

| 6 |

|

314 |

| 7 |

|

301.33 |

| 8 |

|

300.5 |

| 9 |

|

295.7 |

| 10 |

|

286.57 |

While token prices kept on decreasing, development activities in Polkadot skyrocketed. Santiment measures development activity by the number of building-related events that a project generates in its public Github repositories, such as pushing a commit, creating and merging pull requests, and releasing new versions. One can easily see how development activities in Polkadot were significantly and consistently higher in Q3 compared to Q2 and Q1, especially in September. Polkadot easily surpassed Ethereum, Solana, Near and Polygon and only came second to Cardano most of the time.

Even though Polkadot’s overall development activities were lower than Cardano’s, its pattern was more consistent. From September 01 to September 20, Polkadot took over Cardano’s reign. This is why throughout September, the 30-day Development Activity ranking in Santiment showed Polkadot and Kusama’s persistent lead.

Decentralization & Security

Nakamoto Coefficient Of Major Networks

Electricity Consumption By Major Proof-of-Stake Networks

| Nodes

[# total] |

Transactions

[Tx/year] |

Total electricity consumption [kWh/year] |

Electricity per node [kWh/year] |

Electricity per transaction

[Wh/Tx] |

Total Carbon emissions [tCO2e/year] |

|

|---|---|---|---|---|---|---|

|

|

3,002 | 11.9 mn | 598,755 | 199.45 | 51.59 | 284.41 |

|

|

297 | 4.0 mn | 70,237 | 236.49 | 17.42 | 33.36 |

|

|

1,015 | 11.8 bn | 1,967,930 | 1,938.85 | 0.166 | 934.77 |

|

|

375 | 2.5 mn | 113,249 | 250.99 | 41.45 | 53.79 |

|

|

1,084 | 93.9 mn | 489,311 | 451.39 | 4.76 | 232.42 |

|

|

1,190 | 190.0 mn | 512,671 | 430.82 | 2.70 | 245.52 |

One might think that the more decentralized a network is, the more electricity the network consumes, as in the case of proof-of-work chains like Bitcoin and Ethereum 1.0. Not necessarily in the case of proof-of-stake systems. According to CCRI energy efficiency report published in January 2022, Polkadot consumes the least amount of annual electricity and consequently releases the least amount of yearly carbon emissions. This result has nothing to do with total transactions; to get the total electricity consumption, the CCRI team first calculated the average energy consumption per node for each network based on hardware requirements before multiplying with the total node number. Among the six surveyed blockchains, Polkadot has the lowest number of nodes and the second-lowest electricity consumption per node, thus the greenest blockchain.

Token Holder & Investor

September 28 witnessed the total number of DOT holders surpassing the 1,000,000 milestone. The market downturn, however, still left its mark. In Q3 2022, there were 1,695 new holders per day on average, 20.61% lower compared to Q2 (2135) and 44.61% lower compared to Q1 (3060). On September 30, for the first time in the year, the daily holder increase was less than 1000 at 824 new holders. Similar to price and marketcap, the KSM holder pattern was also similar to DOT’s.

Polkadot & Kusama Account Overview

By October 5, the biggest DOT whale was holding 58.61M DOT, approximately $374.80M, in which 47.46% was staked. KSM whales were more modest, with the biggest one having only 492,990 KSM, around $21.12M.

VCs Investing in Polkadot and Kusama Ecosystem

As for investors, more than 400 venture capitals have invested in the Polkadot and Kusama ecosystem, holding tokens from the relay chain, parachains and DApps. DFG and AU21 were evidently the most fervent believers in the ecosystem, with 53 and 40 projects in their portfolios respectively. NGC Ventures, Hypersphere, Illusionist Group and CMS Holdings all invested in more than 30 projects.

Parachain

Q3 2022 concluded with an auction win for OAK Network on September 30, making it the 28th parachain on Polkadot. As for Kusama, 54 auctions were successfully carried out in total to make way for 41 parachains. Since XCM, a messaging format that allows communication across consensus systems was launched on Kusama way before on Polkadot, 24 chains on Kusama had opened XCM channels with one another, twice as many as chains that had enabled XCM transfer on Polkadot.

XCM Transfers of Top Polkadot & Kusama Parachains in Q3 2022

In terms of XCM transfer value, the top six positions belonged to three pairs of sister networks: Moonbeam/Moonriver, Acala/Karura and Parallel/Heiko. Despite topping the chart with $1M worth of assets transferred in within one week of September, Parallel appeared to be trailing after other big six in the longer run. Among those, Moonbeam remained the most active in Q3, accumulating $56.88M in value transferred in with a total of 19,160 transactions and $39.68M in value transferred out with 10,319 transactions. The network also recorded 10M transactions on September 8 and surpassed 300,000 unique addresses just four days after.

Acala came second at $21.89M value transferred in and $27.05M value transferred out. Clearly, the August incidents that led to a one-month period of activity halting on the network did not have much impact throughout the course of three months. On October 5, Acala officially resumed their operations on all functionalities, promising a remarkable comeback in Q4.

Governance & Grant

Following the introduction of Governance 2.0 that was discussed in the Polkadot Deep Dive H1 2022 report, Gavin Wood published the first draft of the Polkadot Fellowship Manifesto on September 26, calling “core developers and protocol technical experts” to apply to be members. In Governance 2.0, the Polkadot Fellowship will replace the current Technical Committee with three main responsibilities: providing technical advisory to the governance system, maintaining and building core protocols, and promoting education on Polkadot technology and philosophy. To guarantee that the Fellowship exists to advance the political decentralization of the network, no decision-making authority against the will of the community is granted to this group of experts.

DOT Treasury Activity

Web3 Foundation Grants By Category

The DeFi Economy

Total Value Locked By Chain

DEX (AMM)

In this section, we survey 13 decentralized exchanges (automated market makers) on Polkadot and Kusama, both native and multi-chain. For easy visualization purposes, we separate them into two groups: those whose average total value locked (TVL) in Q3 was higher than $10M, and those lower than $5M.

Interestingly, the top five DEX leaders in Q3 were all DApp’s products rather than parachain’s. ArthSwap continued to be the number one DEX on Astar Network, even with the competition from Zenlink, while Solarbeam was the only representative from Moonriver Network in the chart. Compared to Moonbeam Network’s native DEX StellaSwap and multi-chain DEX Curve Finance, these three projects did not experience much volatility in the surveyed period.

DEX with Average TVL Higher Than $10M

The impact of the Nomad bridge hack on StellaSwap could not be clearer: within one day from August 1 to August 2, its TVL was divided by three times, plummeting from $31.56M to $11.21M. From that point on, StellaSwap TVL hovered around $8.75M, reaching peak on August 12 at $13.46M and hitting bottom on September 6 at $6.60M. Apparently, the unfortunate incident had pulled StellaSwap far down from the previously unbeatable first to fifth position from mid-August onwards. As part of the rebuilding process, the team submitted a level-3 Moonbeam ecosystem grant proposal of 7,833,600 GLMR (about $3.89M) in total to incentivize strategic farms in the course of six months which was passed by community vote on October 9.

Though also running on Moonbeam as StellaSwap, Curve Finance was not affected by the Nomad bridge hack as it did not rely on wrapped assets as much as on Lido’s liquid staking asset pool (xcDOT/stDOT). In fact, the multi-chain DEX took the opportunity to quickly double its TVL from $4.78M to $9.24M in just the week of July 11 to 18. Curve Finance consistently led the TVL race from August 9, and by the end of Q3 its TVL had grown 499% compared to the quarter’s beginning.

DEX with Average TVL Lower Than $5M

In the lower TVL ranking, Beamswap did not manage to hold its leading position for too long: the steep slide in its TVL meant that Beamswap had to yield to Karura and Beefy on Moonbeam after the first half of July. After announcing the $1M worth of staked GLINT, Beamswap’s DEX TVL nearly doubled in a day, from $3.59M to $6.51M on July 31 before diving back to $4.08M just three days later.

Similar to Beamswap, Beefy on Moonbeam’s TVL also went through a dramatic dip of 35.59% from $3.99M on August 1 to $2.57M on August 2, likely due to the panic withdrawal after the Nomad incident. While the sister Beefy on Moonriver did not see much fluctuation in TVL in Q3, Beefy on Moonbeam’s TVL shot up 258.13% within the span of 8 days, from $2.03M on August 29 to $5.24M on September 6 and remained relatively stable on top of the chart in the remaining period.

If Beamswap and Beefy on Moonbeam dominated the first and last third of Q3, then Avault Finance was the star of the middle third. Launched on July 8 with a modest starting TVL of $1.10M, Avault gradually worked its way up before securing an impressive increase of almost two times in two days from $3.07M on August 9 to $6.10M on August 11. It would be interesting to see how the competition among these three DEXes unfold when 2022 comes to an end, as their TVL nearly collided by the end of this quarter.

Lending & Borrowing (Money Market)

Unsurprisingly, Moonwell Artemis suffered the same way StellaSwap did: in three days, its TVL crashed 78.45% from $103.04M on August 1 to $22.20M on August 4, pushing it down from the first to the third position in a four-project ranking. To rebuild the protocol, Moonwell Artemis proposed a Moonbeam Foundation Grant valuing at 4,166,400 GLMR (approximately $2.08M) and was approved on October 9.

Because of this incident, Parallel rose up to lead the lending race in the last two-third of Q3, surpassing $75M in TVL at its peak on August 6. At the bottom of the chart, Starlay had lost 47.79% of its TVL since the quarter started at $13.18M.

TVL of Lending & Borrowing Protocols

Liquid Staking

TVL of Liquid Staking Protocols

Stablecoin

Probably the most terrific news on stablecoin this quarter is Tether’s launch on Polkadot with an initial supply of 3M USDT after quietly increasing its supply on Kusama to 3.5M USDT. Right after the launch, Astar Network was the very first parachain to open XCM transfers of USDT, and Moonbeam Network quickly followed suit by making Polkadot-native USDT available for use on its DApp.

Stablecoin Total Issuance

Non-fungible token (NFT)

NFT Marketplace

NFT Marketplace Daily Volume

GameFi

The first NFT collection ever sold-out on Moonbeam Network GlimmerApes ranked first in sales volume and overtook the second runner-up GLMR Jungle by a large margin of 35K GLMR, approximately $14.8K. However, both collections were created by the GLMR Apes DAO, with the latter being part of The Great Escape, the first Play-to-Earn Game on Moonbeam Network. Within the first month of launching, the GameFi project had achieved impressive milestones: about 14,500 games had been played by 210 unique players, and 8,800 GLMB collected by the Jungle Bank while 5,600 GLMB had been burned. Two Moonbeam versions of the classic CryptoPunks and Bored Ape Yacht Club (BAYC) came third and fourth respectively.

MoonFit Beast and Beauty, a collection by the fitness and lifestyle GameFi app MoonFit ranked fifth after only a few months of launching. 500 NFTs were sold out in the first sale round in under 30 minutes at 39,500 GLMR valuation, and 1500 NFTs in the second sale round at 178,500 GLMR valuation, totalling 218,000 GLMR in primary market sales volume from both rounds. MoonFit Mint Pass, a whitelist free-mint collection also recorded remarkable sales volume of 11,478.18 GLMR in the secondary market.

Top 10 NFT Collection On Moonbeam Network By All-time Volume

| # | Collection | Volume |

|---|---|---|

| 1 |

GlimmerApes111 Owners / 1,001 Items |

|

| 2 |

GLMR Jungle520 Owners / 3,333 Items |

|

| 3 |

Moonbeam Punks1149 Owners / 4,200 Items |

|

| 4 |

Moonbeam BAYC111 Owners / 1,001 Items |

|

| 5 |

MoonFit Beast & Beauty632 Owners / 2,000 Items |

|

| 6 |

Ultimate Harvest Moon9,504 Owners / 41,552 Items |

|

| 7 |

MOONPETS622 Owners / 5,000 Items |

|

| 8 |

Moonbeam Ape Yatch Club111 Owners / 1,001 Items |

|

| 9 |

Bunch of Bananas97 Owners / 125 Items |

|

| 10 |

MoonFit Mint Pass1,889 Owners / 2,998 Items |

|

DAO

ChaosDAO

One of the earliest and most impactful DAOs in the Polkadot and Kusama ecosystem, ChaosDAO, celebrated their one-year anniversary on July 13. ChaosDAO has always grown 100% organically with “Quality over Quantity” as its founding principle, and with one goal in mind: bring together and connect the most knowledgeable individuals in the space. The DAO features the NFT collection Chaos-DAO Apes for membership access and governance. By October 24, the collection had recorded close to 4K KSM in trading volume with a floor price of 109 KSM and a top sale of 179 KSM. 23 DAOists, the caretakers of the server, are currently running ChaosDAO, including members from notable projects in the ecosystem.

Astar Degens

As implied by its name, Astar Degens is a community-based VC DAO that puts focus on the Astar ecosystem. Managed by 10 members in the DAO council, by the end of September 2022, Astar Degens had received more than 1M ASTR in their dApp Staking rewards and over 200K ASTR as NFT royalties on tofuNFT. To gain voting rights in the DAO, one needs to own at least one out of 10,000 Astar Degen Apes NFTs. The collection had a cumulative trading volume of 9.6M ASTR and a floor price of 1,800 ASTR on October 24.

GLMR Apes

Coincidentally, all three DAOs discussed so far use the ape imagery for their governing NFTs. As mentioned above in the GameFi section, GLMR Apes NFT collection containing 1001 items is the first ever sold out on Moonbeam Network, and is still topping the chart in the secondary market. The governing Jungle Council consists of 10 members with half in the core team and half classified as Wise Apes.

Take Flight Alpha

Founded in January 2022, the 30-member TFA DAO focuses on running a collator node for Moonbeam Network and building a community of over 600 participants. They are currently retaining approximately 4.5M GLMR in staked value for their collator node which returns a 29% APY to delegators. In May 2022, TFA DAO introduced the MooonPets NFT collection made up of 5000 items in order to gamify participation. In Q3, the reported retention rate of MoonPets holders was about 60%.

Web3

Wallet

| Types | Legacy Wallets | Multi-chain Wallets | Native Wallets |

|---|---|---|---|

| Examples | Polkadot {.js}, Fearless Wallet, Polkawallet | Enkrypt, Math Wallet, Rabby | SubWallet, Nova Wallet, Talisman |

| Substrate compatibility | |||

| EVM compatibility | |||

| User-friendly UX/UI | |||

| Substrate-specific features |

SocialFi

Subsocial Daily Activities in Q3 2022

Joystream Cumulative Activities Q3 2022

Bridge

Closing Thoughts

On October 22, Polkadot and Parity co-founder Gavin Wood announced his stepping down from the CEO position of Parity Technologies to take on the title of Chief Architect. In place of him, Parity co-founder and previously Chief Commercial Officer Björn Wagner has become the new CEO.

This move signaled a positive and promising change of growth direction for Polkadot, as more attention will be paid to ecosystem development and growth expansion that targets end users. In the next months, more events like DOTinVietnam, the first official Polkadot meetup in Vietnam co-organized by SubWallet and other leading projects in the ecosystem that attracted more than 200 developers and investors, will happen across the globe and on a much larger scale. Polkadot’s explosion, therefore, is only a matter of time.

Get Started With Polkadot

About

dotinsights is a research-focused initiative by SubWallet, the leading non-custodial Polkadot and Kusama wallet. By providing the most comprehensive and up-to-date Polkadot & Kusama Ecosystem Map along with data-driven Polkadot Deep Dive reports on a quarterly basis, our vision at dotinsights is to become the official and trusted research hub and data platform of Polkadot.

Contributors

DJ Hà Trang

Alex Vu

Le Bui

Dung Nguyen

Hieu Dao

& Head of Product

Frankie Kao

& Creative Director

Thony

& Head of Strategy

Ryan Dinh

Development Manager

Kate Ha

Emily Nguyen

Mabel Nguyen

Marco Da Rocha (Pitcoin)

Eunice Feng

SrSlayer

Rudy Wicaksono

Sang-hyun Rhee